In controtendenza sul mercato e nonostante la pandemia Stellantis ha fatto registrare nel 2021 l’11,8% di margine AOI(1)(2) e un utile netto record di € 13,4 miliardi(1) su base pro-forma. Nello stesso anno la società ha ridistribuito ai suoi dipendenti 1,9 miliardi di euro come riconoscimento del loro contributo ai risultati dell’azienda che ricordiamo è nata dalla fusione tra FCA e PSA

Stellantis N.V., nuova Società costituita solamente il 17 gennaio 2021, ha sin dal primo giorno puntato a massimizzare le sinergie scaturenti dalla fusione e a costruire una solida performance commerciale, trainata sin dal primo giorno da una chiara focalizzazione degli obiettivi e da una straordinaria velocità di esecuzione, elementi che hanno portato nello stesso anno risultati record.

Per quanto attiene al presidio del mercato va ricordato che nel 2021 Stellantis ha lanciato più di 10 nuovi modelli, tra cui Citroën C4, Fiat Pulse, DS4, Jeep® Grand Cherokee, Wagoneer, Maserati MC20, Opel Mokka, Opel Rocks-e e Peugeot 308.

Stellantis ha inoltre annunciato ambiziosi piani per l’elettrificazione e il software nel corso di quest’anno, con un programma di investimenti di oltre 30 miliardi di euro entro il 2025 e l’annuncio di forti partnership nelle tecnologie delle batterie, nei materiali per batterie e nello sviluppo software, accelerando al tempo stesso il suo slancio commerciale nei veicoli a basse emissioni (LEV) il cui attuale listino può contare su 34 modelli, compresi i furgoni medi a celle a combustibile a idrogeno.

Le vendite globali di LEV hanno raggiunto 388.000 unità, in aumento del 160% anno su anno, con la prima posizione nelle vendite di furgoni elettrici a batteria in EU30.

Stellantis ha inoltre confermato la sua forte posizione nel mercato globale dei veicoli commerciali con la leadership sia nel mercato EU30 che in Sud America, e ha raggiunto il suo record storico nelle vendite mondiali di pick-up con circa 1 milione di veicoli venduti.

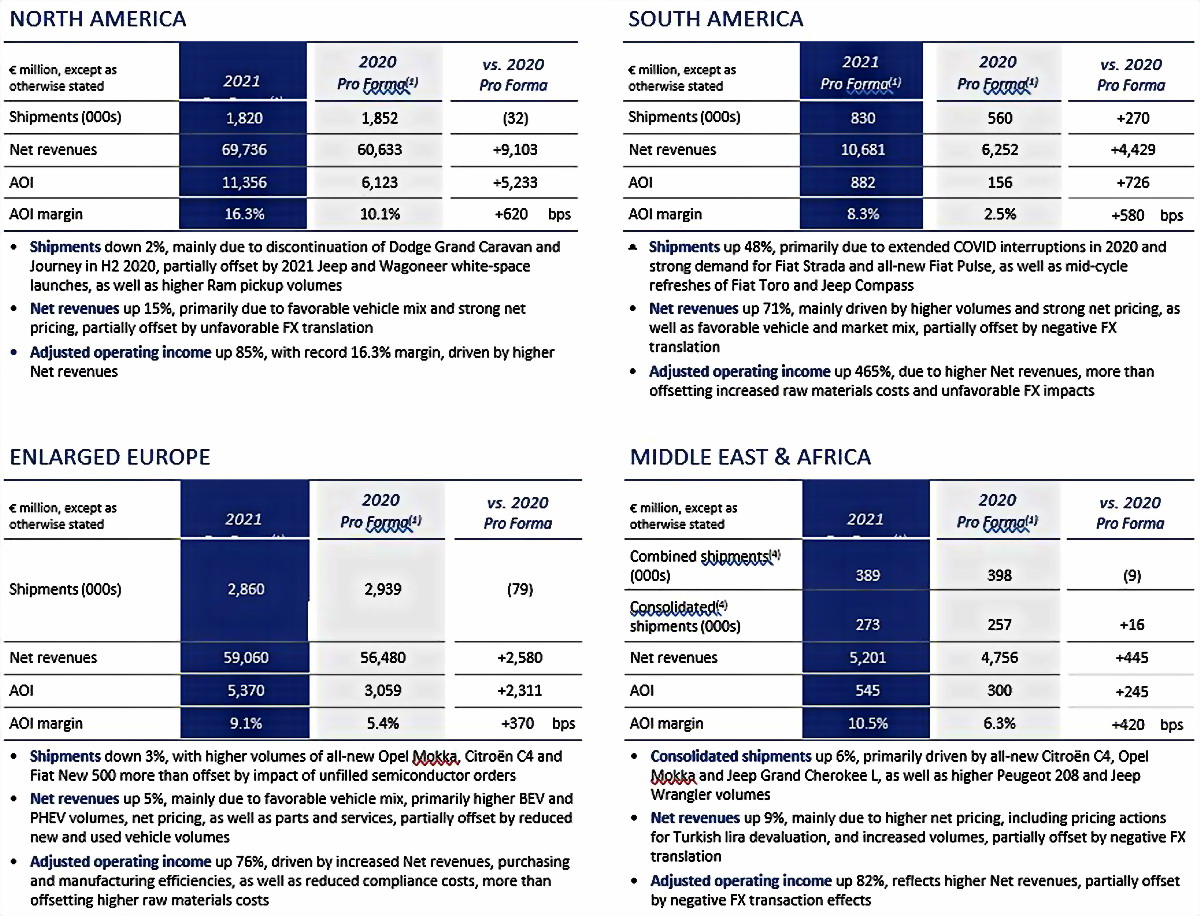

Nel dettaglio si nota che:

- in Nord America, la Jeep Wrangler 4xe è stata il veicolo elettrico ibrido plug-in più venduto sul mercato retail statunitense nel 2021;

- in Sud America, Stellantis è stata leader di mercato nel 2021 con una quota del 22,9%; è stata inoltre leader nei veicoli commerciali con una quota di mercato del 30,9%;

- in Europa allargata, Stellantis è stata leader nel perimetro EU30 per i veicoli commerciali, con una quota di mercato del 33,7% per il 2021. La Peugeot 208 è stata il veicolo più venduto in EU30 e la 2008 è stata n. 1 nel segmento B-SUV in EU30 per il 2021;

- in Medio Oriente e Africa, le consegne consolidate sono aumentate del 6%, mentre la quota di mercato è cresciuta anno-su-anno nella maggior parte dei mercati principali.

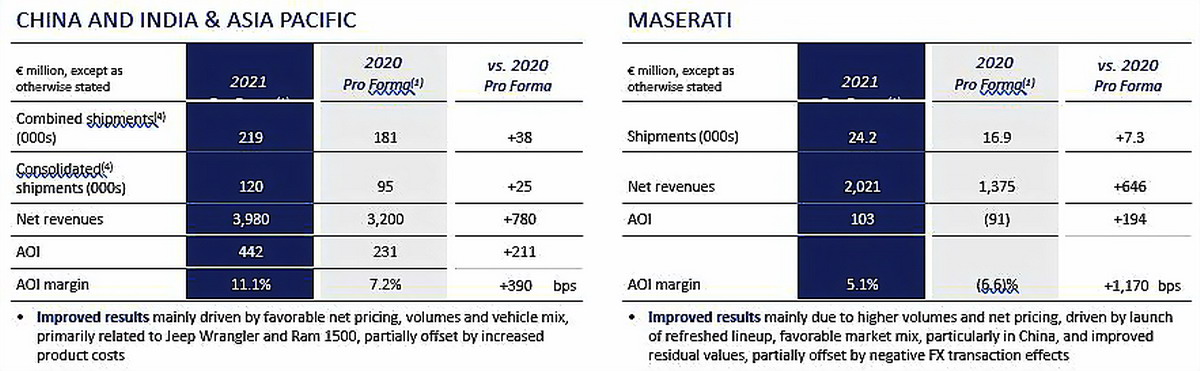

- in India e Asia Pacifico, la Società si sta preparando a lanciare la nuova Citroën C3, sviluppata e prodotta in India;

- in Cina, Dongfeng Peugeot Citroën Automobile Co. Ltd (DPCA) ha più che raddoppiato il volume di vendite annuali del 2020 con 100.000 unità vendute e Stellantis è diventata il quarto maggiore distributore di ricambi nell’aftermarket indipendente (IAM) cinese, con un incremento delle vendite di circa il 30% anno su anno;

- in Nord America e Cina, Maserati ha riportato, nel 2021, un aumento delle sue quote di mercato rispettivamente del 2,9% e del 2,7% (globale 2,4%).

La Finanza

Stellantis ha inoltre compiuto passi importanti per rafforzare le sue operazioni finanziarie globali sia negli Stati Uniti, con la creazione di Stellantis Financial Services US Corp., sia in Europa attraverso il rafforzamento delle partnership finanziarie con BNP Paribas Personal Finance, Crédit Agricole Consumer Finance e Santander Consumer Finance.

I dipendenti

In tutti i paesi in cui Stellantis è presente, la Società nel 2021 ha redistribuito ai suoi dipendenti1 – in relazione ai risultati del primo anno e in un contesto difficile (pandemia, carenza di semiconduttori, ecc.) – benefit per € 1,9 miliardi con un aumento del 70% rispetto ai 770 milioni di euro ridistribuiti l’anno scorso da ciascuna delle precedenti società e questo grazie ad una politica delle retribuzioni e dei benefit che vuole valorizzare l’impegno dei dipendenti attraverso un approccio «pagamento per performance».

Le dichiarazioni di Carlos Tavares, CEO di Stellantis

A proposito del Personale: “I dipendenti sono il cuore di Stellantis. È grazie alla loro continua attenzione all’esecuzione e all’eccellenza che siamo stati in grado di raggiungere risultati record nel nostro primo anno come Stellantis. Ogni dipendente di Stellantis ha assunto il compito straordinario nel 2021 di combinare due case automobilistiche mentre affrontava gravi sfide esterne. Il nostro obiettivo è che tutti i dipendenti beneficino della crescita redditizia dell’azienda. Siamo lieti di premiare e ringraziare i membri del nostro team per il loro instancabile impegno”.

A proposito del Personale: “I dipendenti sono il cuore di Stellantis. È grazie alla loro continua attenzione all’esecuzione e all’eccellenza che siamo stati in grado di raggiungere risultati record nel nostro primo anno come Stellantis. Ogni dipendente di Stellantis ha assunto il compito straordinario nel 2021 di combinare due case automobilistiche mentre affrontava gravi sfide esterne. Il nostro obiettivo è che tutti i dipendenti beneficino della crescita redditizia dell’azienda. Siamo lieti di premiare e ringraziare i membri del nostro team per il loro instancabile impegno”.

Sulla performance di Gruppo: “I risultati record di oggi dimostrano che Stellantis è ben posizionata per realizzare una forte performance, anche nei contesti di mercato più incerti. Vorrei ringraziare calorosamente tutti i dipendenti di Stellantis di tutte le Region, i marchi e le funzioni per avere contribuito a costruire la nostra nuova Società con la diversità che ci alimenta. Vorrei anche cogliere questa occasione per ringraziare il team manageriale per l’impegno incessante profuso nel contrastare e superare situazioni fortemente avverse. Insieme, siamo concentrati sull’attuazione dei nostri programmi proseguendo nel nostro viaggio per diventare un’azienda tecnologica per la mobilità sostenibile”.

I dati

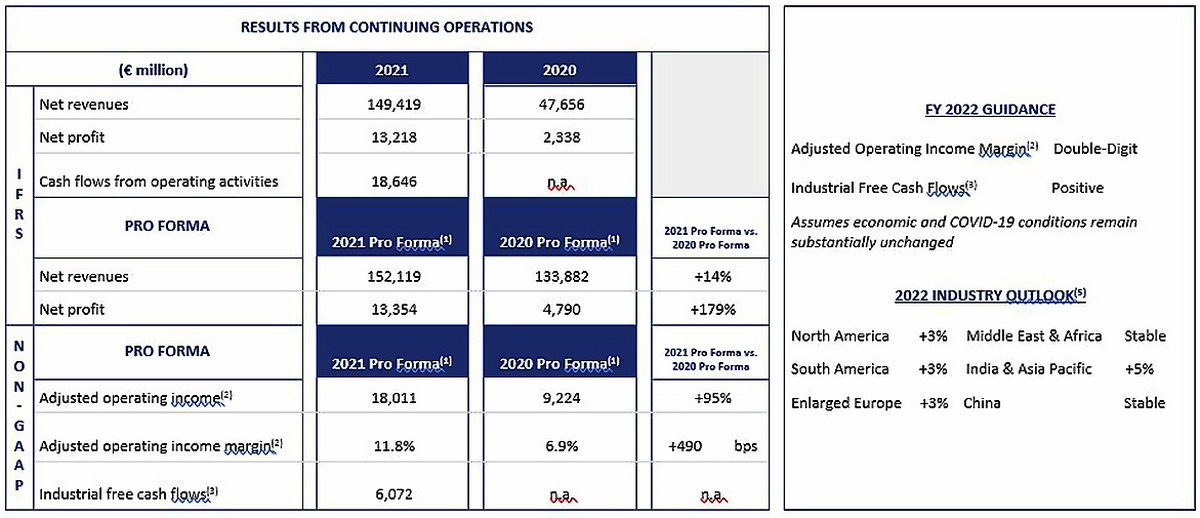

- Ricavi netti (1)pari a 152 miliardi di euro, in aumento del 14%.

- Risultato operativo rettificato(1)(2)(«AOI») quasi raddoppiato a 18,0 miliardi di euro, con margine del 11,8% e tutti i segmenti positivi.

- Utile netto(1)pari a 13,4 miliardi di euro, quasi triplicato anno-su-anno.

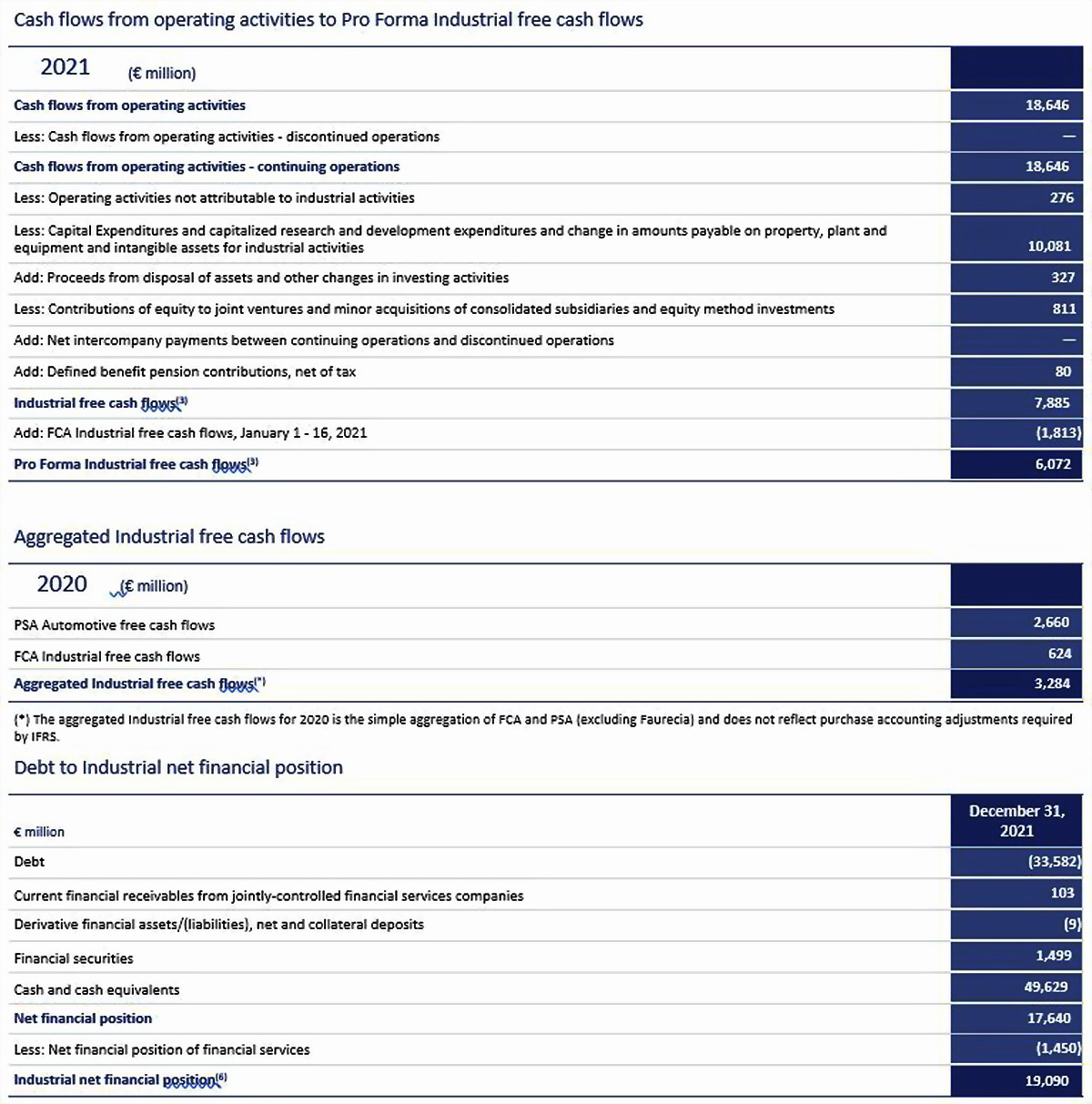

- Flusso di cassa industriale(1)(3) disponibile di 6,1 miliardi di euro, trainato principalmente da forti sinergie di cassa e redditività.

- Forte esecuzione del piano di sinergie con benefici di cassa netti di ~3,2 miliardi di euro.

- Forte liquidità industriale disponibile di 62,7 miliardi di euro.

- 3,3 miliardi di euro di dividendo ordinario da pagare, previa approvazione degli azionisti.

I dati contrassegnati con (1) sono pro-forma e sono presentati come se la fusione fosse avvenuta il 1° gennaio 2020. Fare riferimento alla Nota 1 a pagina 15. Tutti i confronti sono riferiti ai risultati pro-forma(1) dell’esercizio 2020

Le Tabelle di riferimento

n.a = not applicable

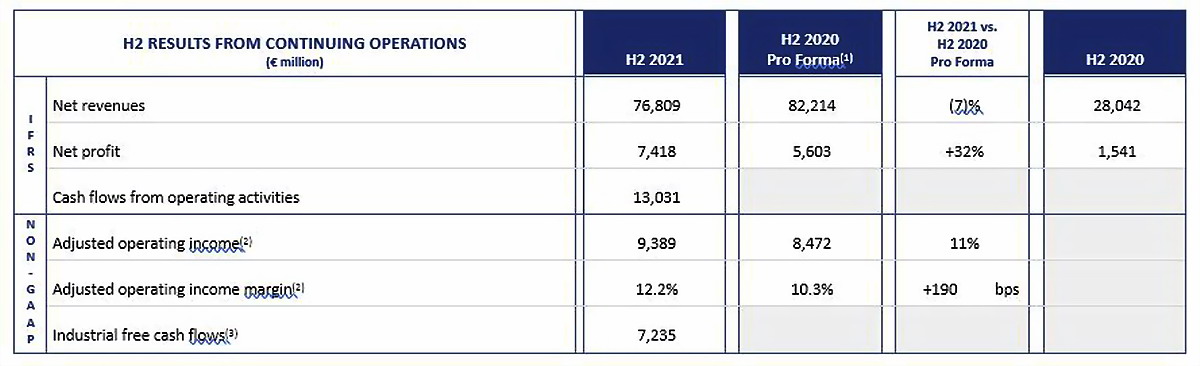

Basis of preparation: All reported data is unaudited. “2021” and “2020” represent results as reportable under IFRS. 2021 includes Legacy FCA from January 17, 2021, following the closure of the merger; “2021 Pro Forma” and “2020 Pro Forma” are presented as if the merger had occurred January 1, 2020. Refer to the section “Notes” for additional detail. Reference should be made to the section “Safe Harbor Statement” included elsewhere within this document

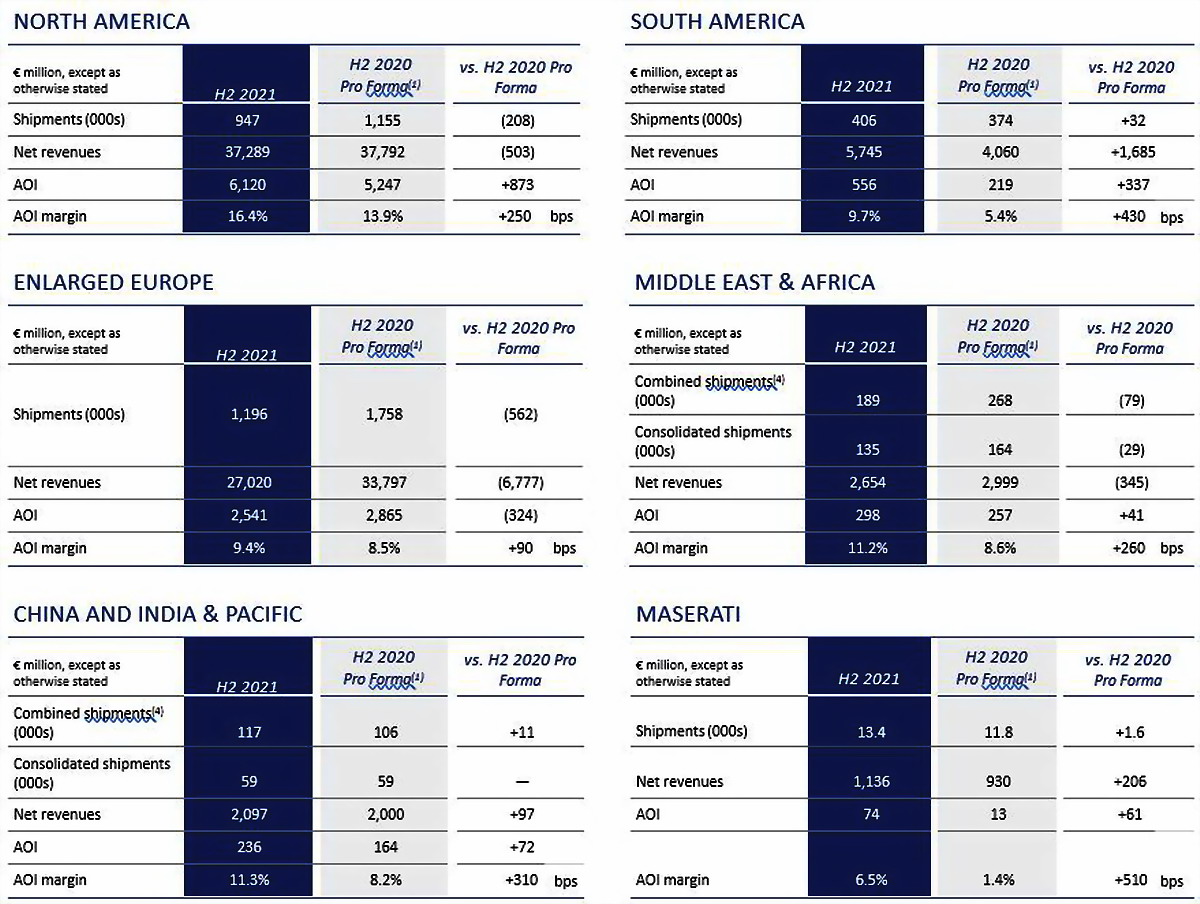

SEGMENT PERFORMANCE

In addition to the commentary provided below, all segments’ shipments and results reflect the impacts of 2020 COVID-related temporary production suspensions and 2021 losses of ~20% of planned production due to unfilled semiconductor orders

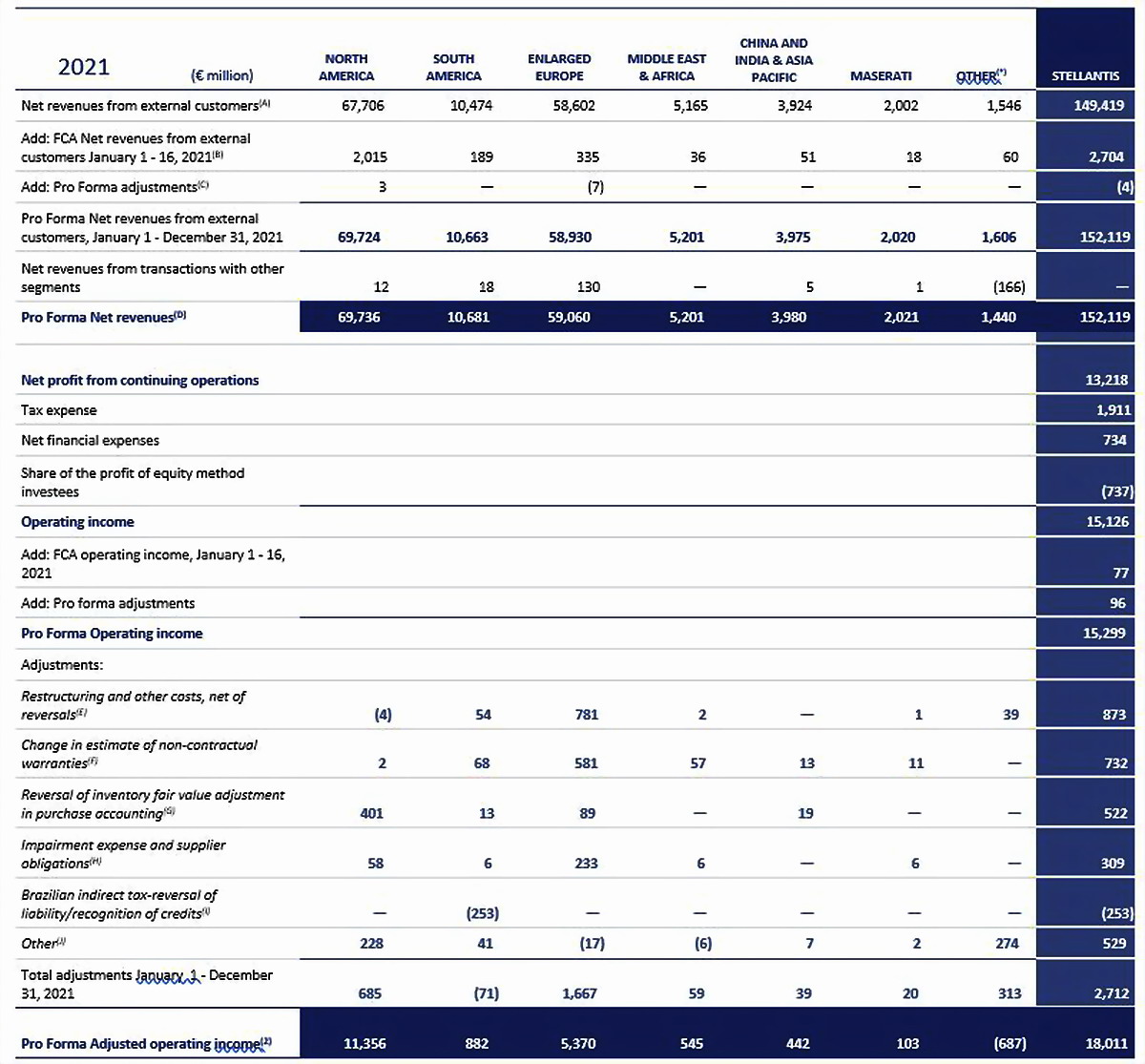

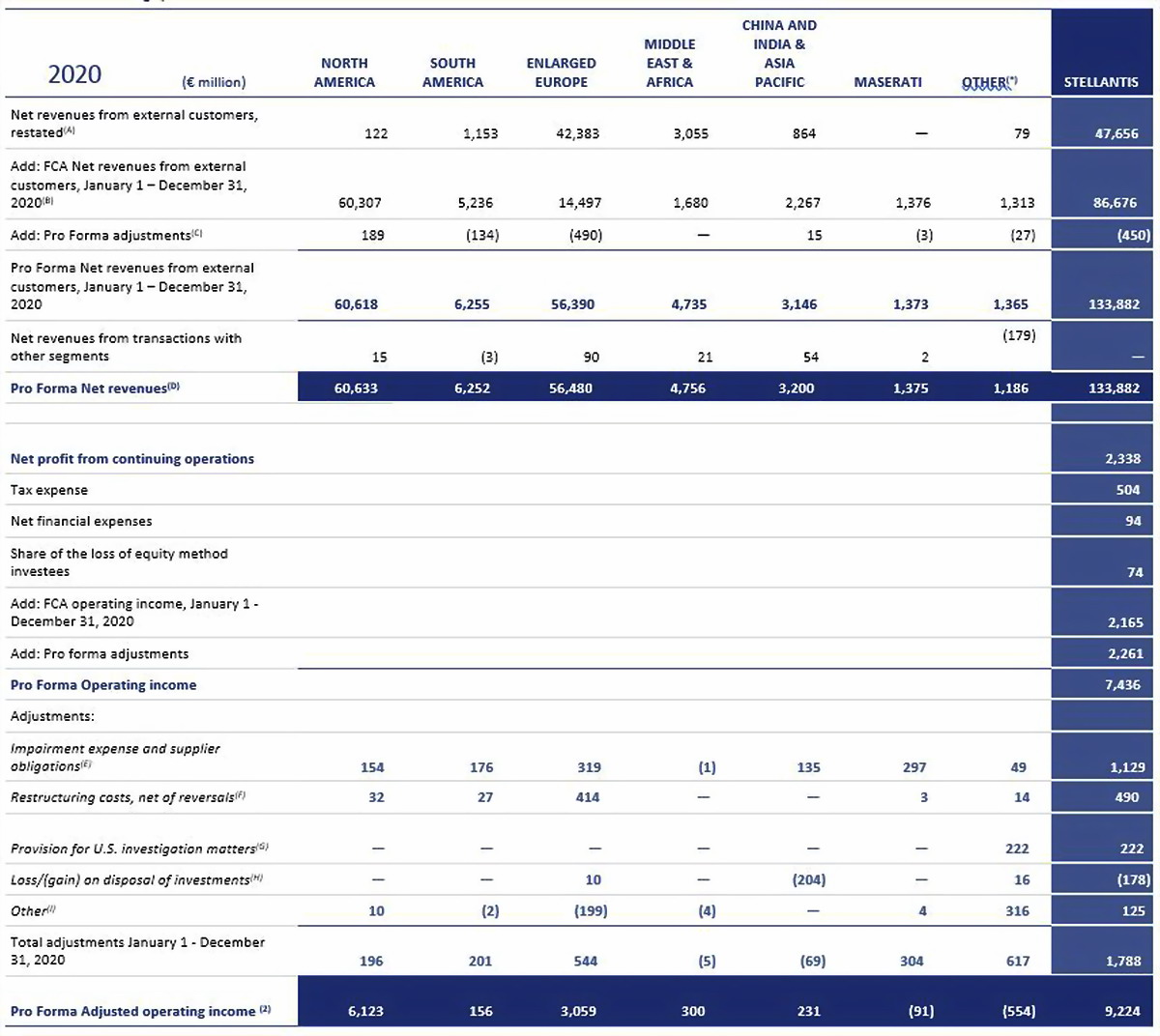

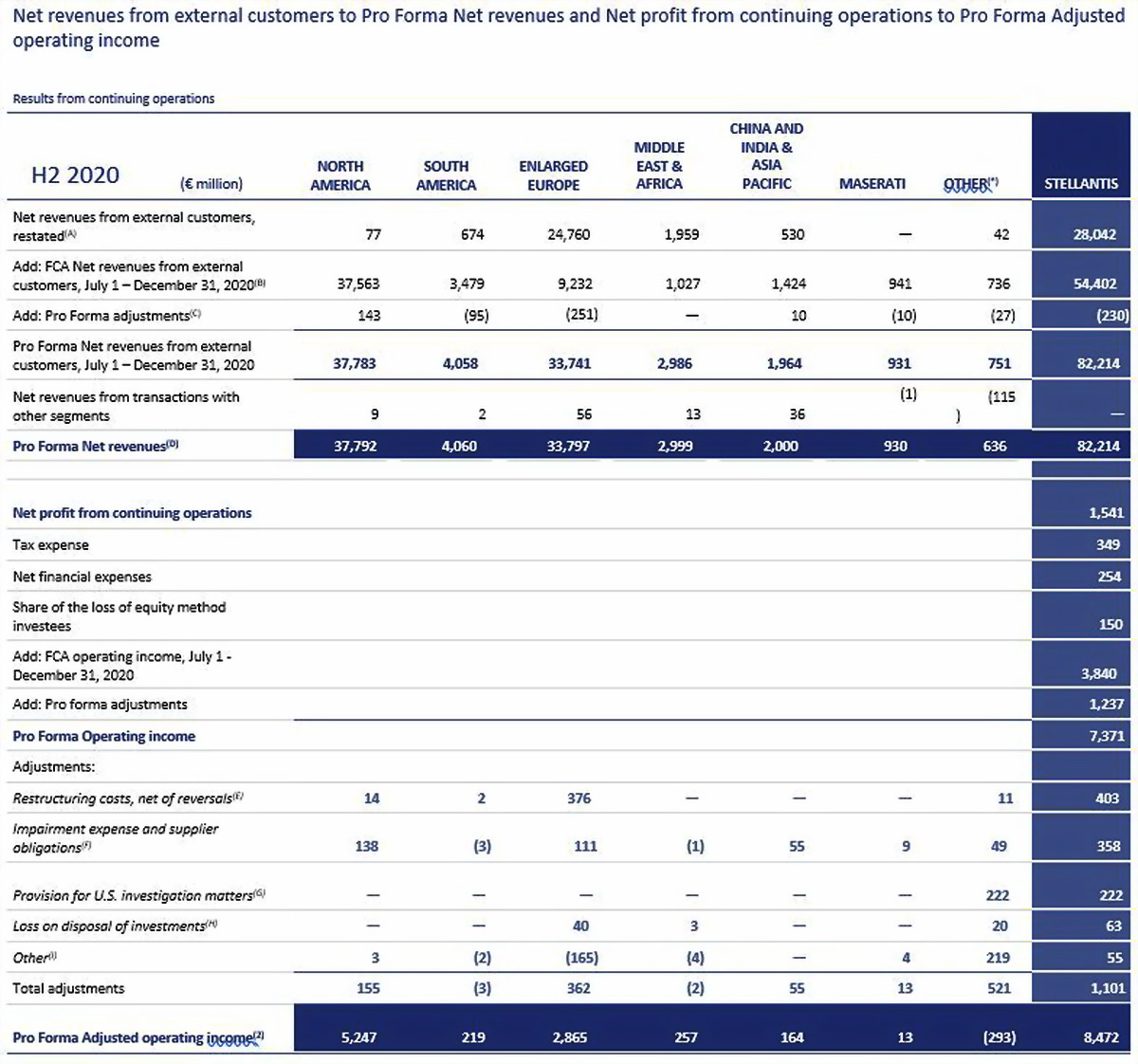

RECONCILIATIONS – Full Year

Net revenues from external customers to Pro Forma Net revenues and Net profit from continuing operations to Pro Forma Adjusted operating income

Results from continuing operations

(*) Other activities, unallocated items and eliminations

(A) PSA was identified as the accounting acquirer in the merger, which was accounted for as a reverse acquisition, under IFRS 3 – Business Combinations, and, as such, it contributed to the results of the Company beginning January 1, 2021. FCA was consolidated into Stellantis effective January 17, 2021, the day after the merger became effective.

(B) FCA consolidated Net revenues, January 1 – January 16, 2021, excluding intercompany transactions

(C) Reclassifications made to present FCA’s Net revenues January 1 – January 16, 2021 consistently with that of PSA

(D) Pro Forma Stellantis consolidated Net revenues, January 1 – December 31, 2021

(E) Restructuring and other costs related to reorganization of operations and dealer network, primarily in Enlarged Europe

(F) Change in estimate for warranty costs incurred after the contractual warranty period

(G) Reversal of fair value adjustment recognized in purchase accounting on FCA inventories

(H) Primarily related to certain vehicle platforms in Enlarged Europe

(I) Benefit related to final decision of Brazilian Supreme Court on calculation of state value added tax

(J) Includes other costs primarily related to merger and integration activities

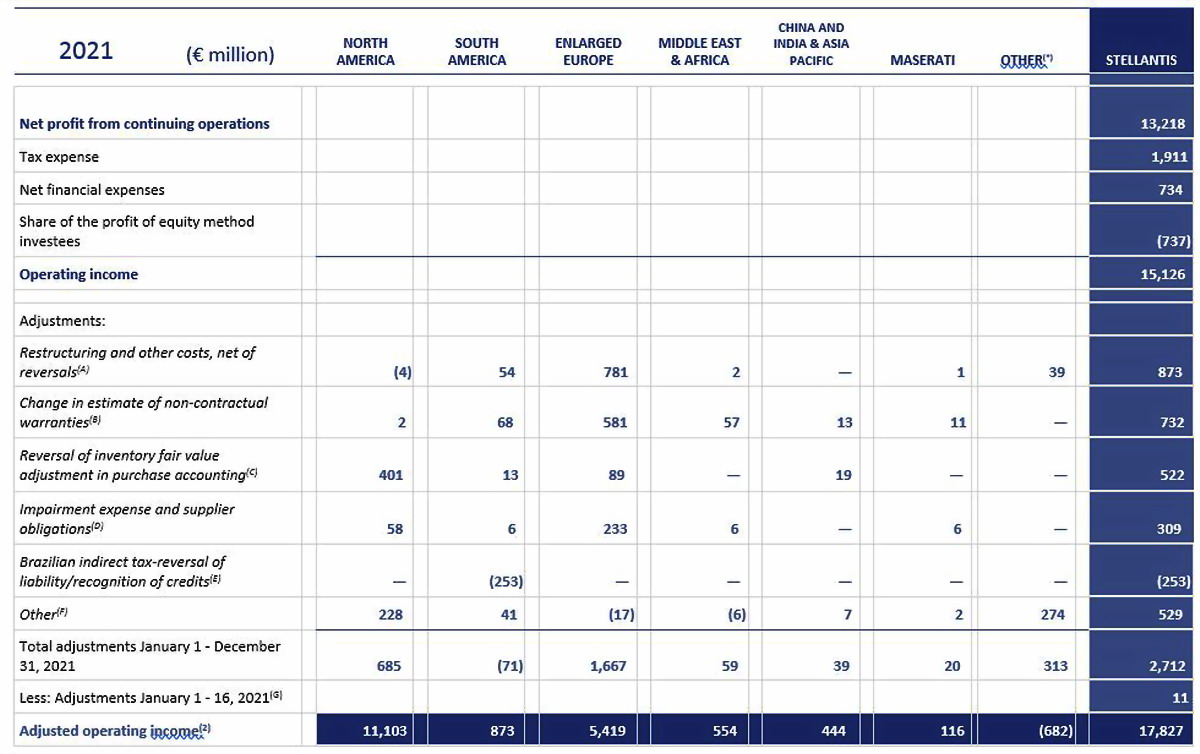

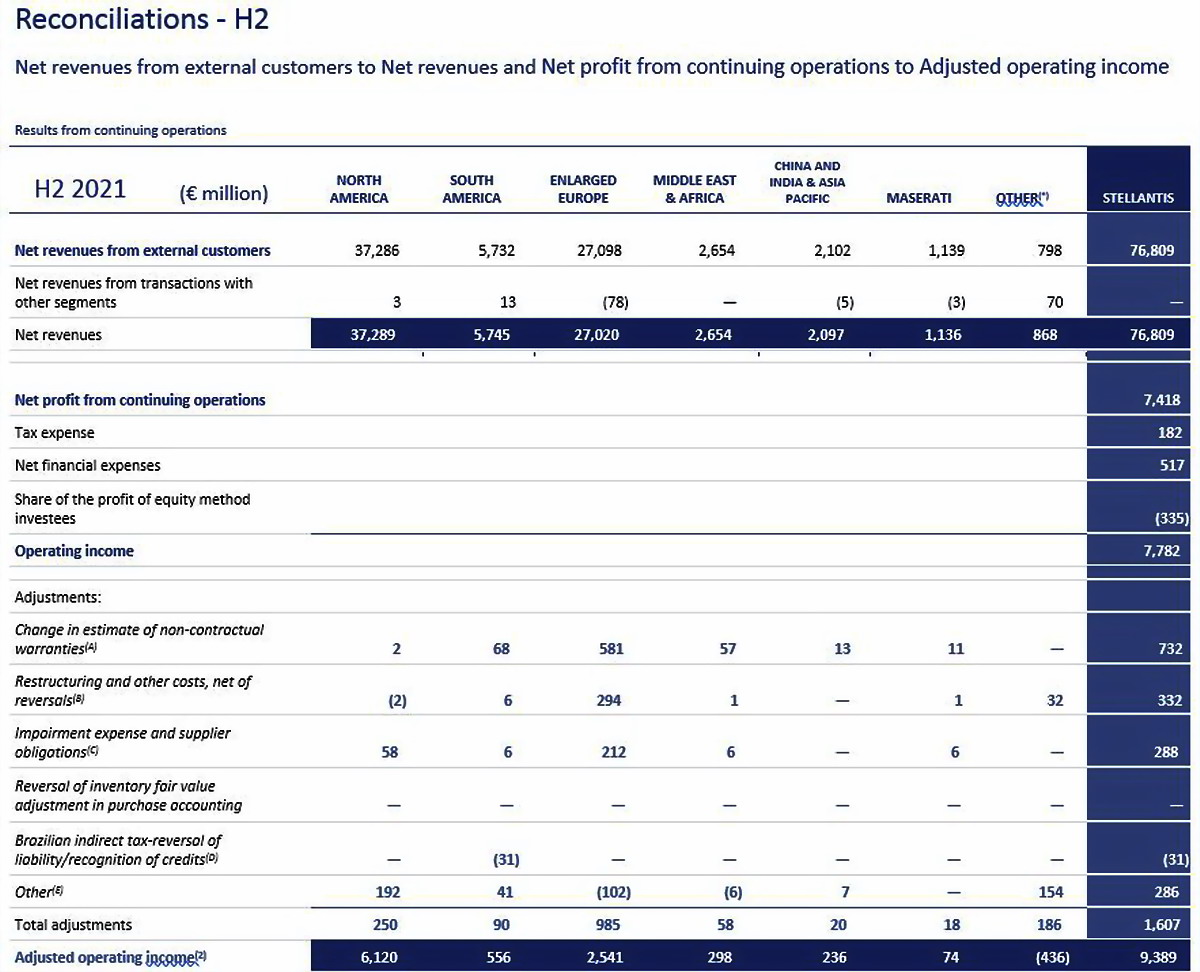

Net profit from continuing operations to Adjusted operating income

Results from continuing operations

(*) Other activities, unallocated items and eliminations

(A) Restructuring and other costs related to reorganization of operations and dealer network, primarily in Enlarged Europe

(B) Change in estimate for warranty costs incurred after the contractual warranty period

(C) Reversal of fair value adjustment recognized in purchase accounting on FCA inventories

(D) Primarily related to certain vehicle platforms in Enlarged Europe

(E) Benefit related to final decision of Brazilian Supreme Court on calculation of state value added tax

(F) Includes other costs primarily related to merger and integration activities

(G) Primarily costs related to the merger

Net revenues from external customers to Pro Forma Net revenues and Net profit from continuing operations to Pro Forma Adjusted operating income

Results from continuing operations

(*) Other activities, unallocated items and eliminations

(A) Net revenues from external customers of PSA as reported, re-presented to reflect the reportable segments presented by the Company, and to exclude the results of Faurecia, which is presented as a discontinued operation in the Income Statement of the Company for the year ended December 31, 2020

(B) Net revenues from external customers of FCA as reported, re-presented to reflect the reportable segments presented by the Company

(C) Reclassifications made to present FCA’s Net revenues consistently with that of PSA

(D) Pro Forma Stellantis consolidated Net revenues presented as if the Merger had been completed on January 1, 2020

(E) Primarily related to impairment expense in North America, South America, Enlarged Europe and China and India & Asia Pacific due to reduced volume expectations primarily as a result of the estimated impacts of COVID, impairments of certain assets in Maserati and certain B-segment assets in Enlarged Europe, as well as impairments in North America due to the change in CAFE penalty rates for future model years

(F) Restructuring costs related to reorganization of operations, primarily in Enlarged Europe

(G) Provision recognized for estimated probable losses to settle matters under investigation by the U.S. Department of Justice, primarily related to criminal investigations associated

with U.S. diesel emissions matters

(H) Primarily related to disposal of Changan PSA Auto Company Ltd (“CAPSA”), which was a joint venture in China

(I) Primarily includes other costs related to merger and litigation proceedings

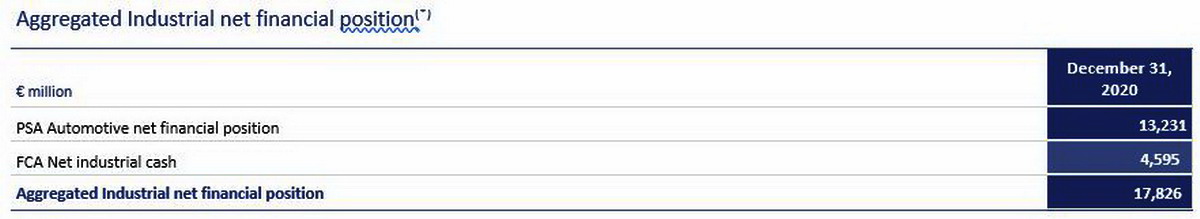

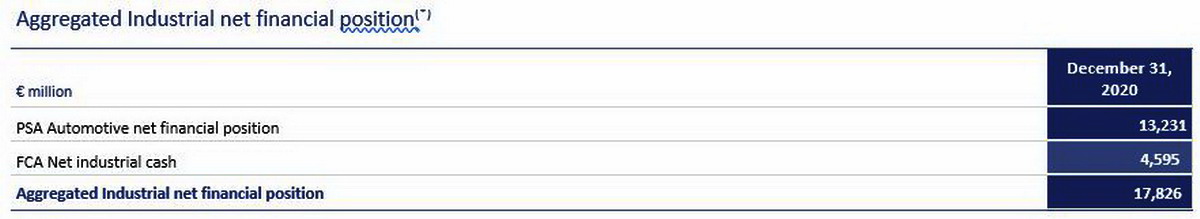

(*)The aggregated Industrial net financial position at December 31, 2020 is the simple aggregation of the previously reported amounts by FCA and PSA (excluding Faurecia) and does not reflect a) fair value adjustments increasing debt by approximately €1,400 million as of January 17, 2021 recorded as part of the purchase accounting adjustments required by IFRS; and b) approximately €230 million of a reduction in the Industrial net financial position to align to the Stellantis definition of Industrial net financial position.

(*) Other activities, unallocated items and eliminations

(A) Change in estimate for warranty costs incurred after the contractual warranty period

(B) Restructuring and other costs related to reorganization of operations and dealer network, primarily in Enlarged Europe

(C) Primarily related to certain vehicle platforms in Enlarged Europe

(D) Benefit related to final decision of Brazilian Supreme Court on calculation of state value added tax

(E) Includes other costs primarily related to merger and integration activities

(*) Other activities, unallocated items and eliminations

(A) Net revenues from external customers of PSA as reported, re-presented to reflect the reportable segments presented by the Company, and to exclude the results of Faurecia, which is presented as a discontinued operation in the Income Statement of the Company for the year ended December 31, 2020

(B) Net revenues from external customers of FCA as reported, re-presented to reflect the reportable segments presented by the Company

(C) Reclassifications made to present FCA’s Net revenues consistently with that of PSA

(D) Pro Forma Stellantis consolidated Net revenues presented as if the Merger had been completed on January 1, 2020

(E) Restructuring costs related to reorganization of operations, primarily in Enlarged Europe

(F) Primarily related to impairment of certain B-segment assets in Enlarged Europe, as well as impairments in North America due to the change in CAFE penalty rates for future model years

(G) Provision recognized for estimated probable losses to settle matters under investigation by the U.S. Department of Justice, primarily related to criminal investigations associated

with U.S. diesel emissions matters

(H) Primarily related to loss on disposal of investment in Enlarged Europe

(I) Primarily includes other costs related to merger and litigation proceedings

NOTES

(1) Completed merger of Peugeot S.A. (“PSA”) with and into Fiat Chrysler Automobiles N.V. (“FCA”) on January 16, 2021 (“Merger”). On January 17, 2021, combined company was renamed Stellantis N.V. (“Stellantis” or “Company”). PSA was determined to be the acquirer for accounting purposes, therefore, the historical financial statements of Stellantis represent the continuing operations of PSA, which also reflect the loss of control and the classification of Faurecia S.E. (Faurecia) as a discontinued operation as of January 1, 2021 with the restatement of comparative periods. Acquisition date of business combination was January 17, 2021, therefore, results of FCA for the period January 1 -16, 2021 are excluded from 2021 results unless otherwise stated. 2021 Pro Forma results are presented as if the merger had occurred on January 1, 2020 and include results of FCA for the period January 1 –16, 2021. H2 2020 and 2020 represent results of the continuing operations of PSA only and are not directly comparable to previously reported results of PSA and reflect accounting policies and reporting classifications of the Company. H2 2020 Pro Forma and 2020 Pro Forma results are presented as if the merger had occurred on January 1, 2020. The fair values assigned to the assets acquired and liabilities assumed have been finalized during the one-year measurement period from the acquisition date, as provided for by IFRS 3.

(2) Adjusted operating income/(loss) excludes from Net profit/(loss) from continuing operations adjustments comprising restructuring, impairments, asset write-offs, disposals of investments and unusual operating income/(expense) that are considered rare or discrete events and are infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance, and also excludes Net financial expenses/(income), Tax expense/(benefit) and Share of the profit/(loss) of equity method investees.

Unusual operating income/(expense) are impacts from strategic decisions, as well as events considered rare or discrete and infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance. Unusual operating income/(expense) includes, but may not be limited to: impacts from strategic decisions to rationalize Stellantis’ core operations; facility-related costs stemming from Stellantis’ plans to match production capacity and cost structure to market demand, and; convergence and integration costs directly related to significant acquisitions or mergers.

For the year ended December 31, 2021, Pro Forma Adjusted operating income includes the Adjusted operating income of FCA for the period

January 1 – 16, 2021. For the year ended December 31, 2020, Pro Forma Adjusted operating income includes the Adjusted operating income

result of FCA for the period January 1 – December 31, 2020. For the six months ended December 31, 2020, Pro Forma Adjusted operating income includes the Adjusted operating income result of FCA for the period July 1 – December 31, 2020.

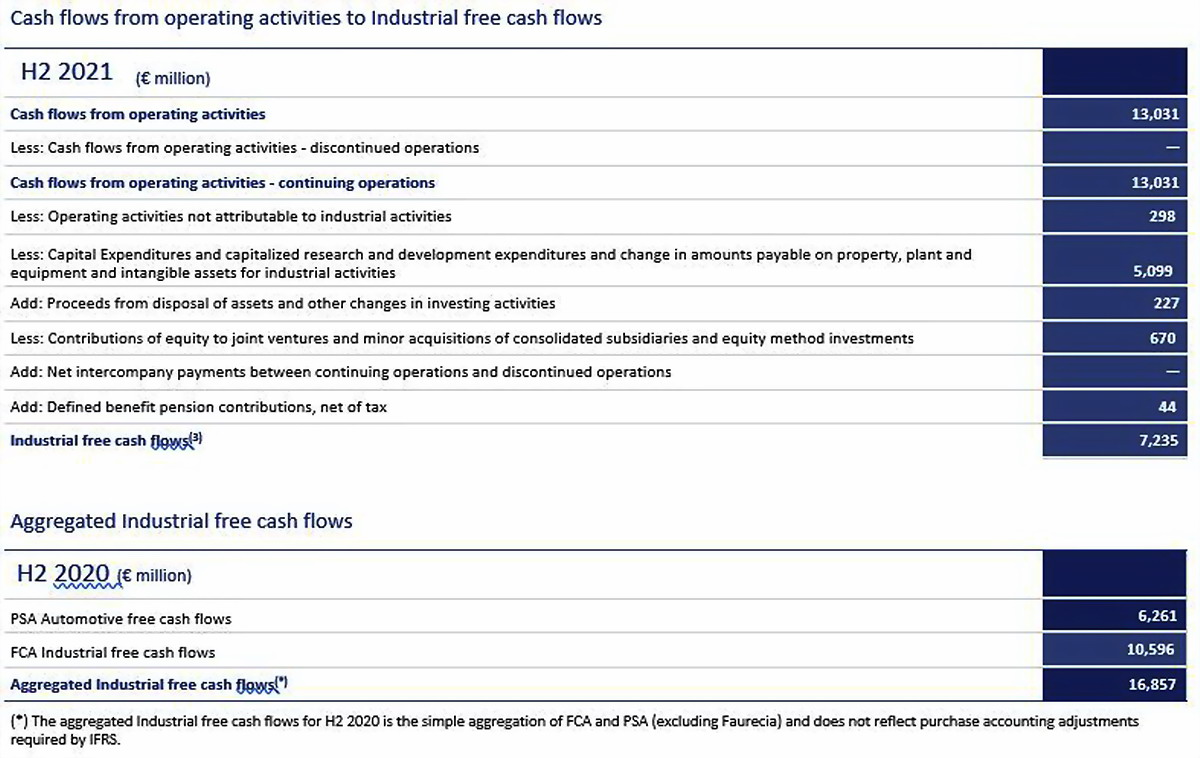

(3) Industrial free cash flows is calculated as Cash flows from operating activities less: cash flows from operating activities from discontinued

operations; cash flows from operating activities related to financial services, net of eliminations; investments in property, plant and equipment and

intangible assets for industrial activities; contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries and equity

method investments; adjusted for: net intercompany payments between continuing operations and discontinued operations; proceeds from

disposal of assets and contributions to defined benefit pension plans, net of tax. For the year ended December 31, 2021, Pro Forma Industrial free

cash flows includes the Industrial free cash flows of FCA for the period January 1 – 16, 2021. The timing of Industrial free cash flows may be

affected by the timing of monetization of receivables and the payment of accounts payables, as well as changes in other components of working

capital, which can vary from period to period due to, among other things, cash management initiatives and other factors, some of which may be

outside of the Company’s control.

(4) Combined shipments include shipments by the Company’s consolidated subsidiaries and unconsolidated joint ventures, whereas Consolidated shipments only include shipments by the Company’s consolidated subsidiaries.

(5) Source: IHS Global Insight, Wards, China Passenger Car Association and Company estimates.

(6) Industrial net financial position is calculated as Debt plus derivative financial liabilities related to industrial activities less cash and cash

equivalents, financial securities that are considered liquid, current financial receivables from the Group or its jointly controlled financial

services entities and derivative financial assets and collateral deposits; therefore, debt, cash and cash equivalents and other financial assets/

liabilities pertaining to Stellantis’ financial services entities are excluded from the computation of the Industrial net financial position. Industrial net

financial position includes the Industrial net financial position classified as held for sale.

Market share information is derived from third-party industry sources (e.g. European Automobile Manufacturers Association (ACEA), Ward’s Automotive, Associação Nacional dos Fabricantes de Veículos Automotores (ANFAVEA)) and internal information.

Represents Passenger cars (PC) and light commercial vehicles (LCV), except as noted below:

- India & Asia Pacific reflects aggregate for major markets where Stellantis competes (Japan (PC), India (PC), South Korea (PC + Pickups), Australia and South East Asia)

- Middle East & Africa exclude Iran, Sudan and Syria

- Maserati reflects aggregate for 17 major markets where Maserati competes and is derived from IHS data, Maserati competitive segment and internal information

Commercial Vehicles market share refers to light commercial vehicles.

EU30 = EU27 (excluding Malta), Iceland, Norway, Switzerland and UK.

Appendix

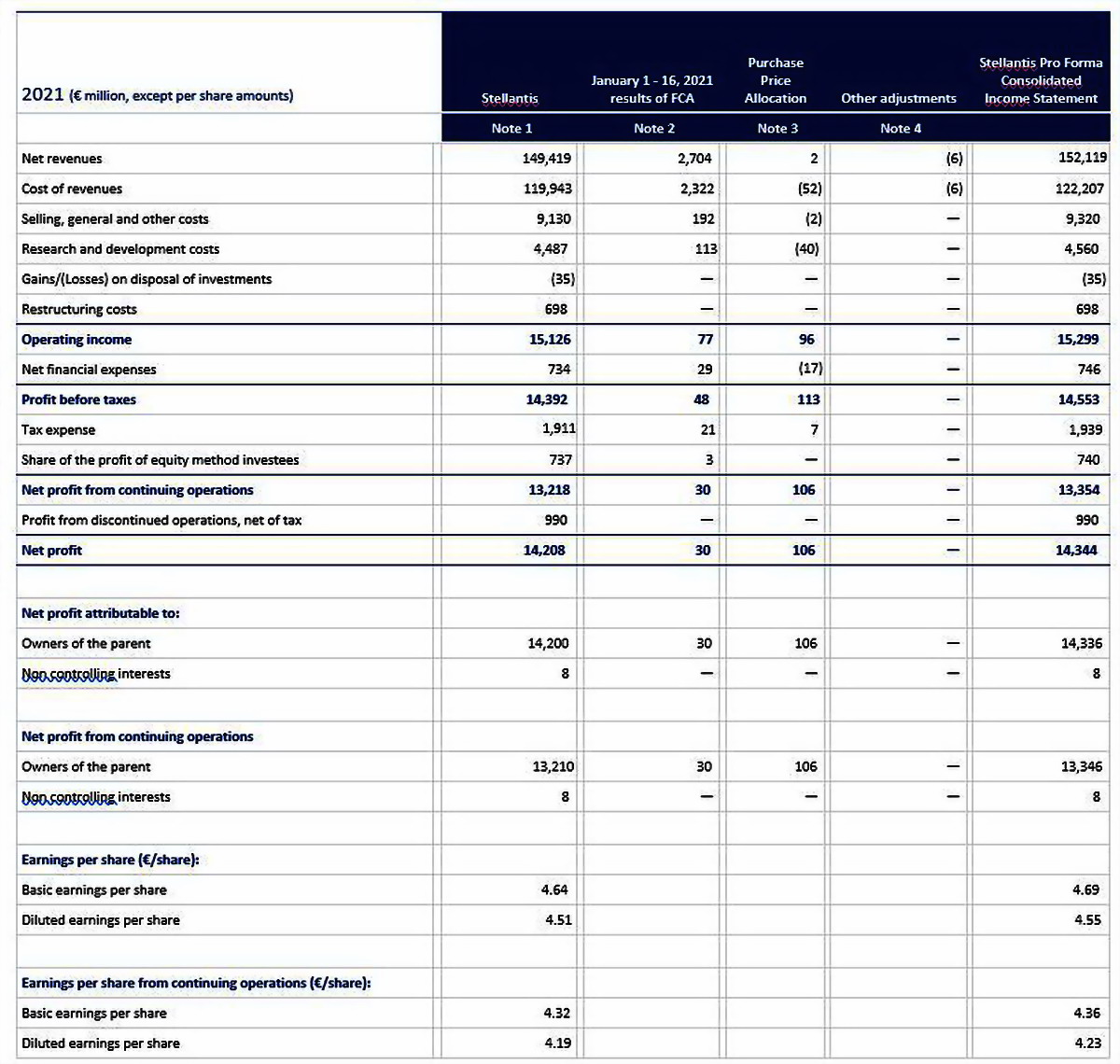

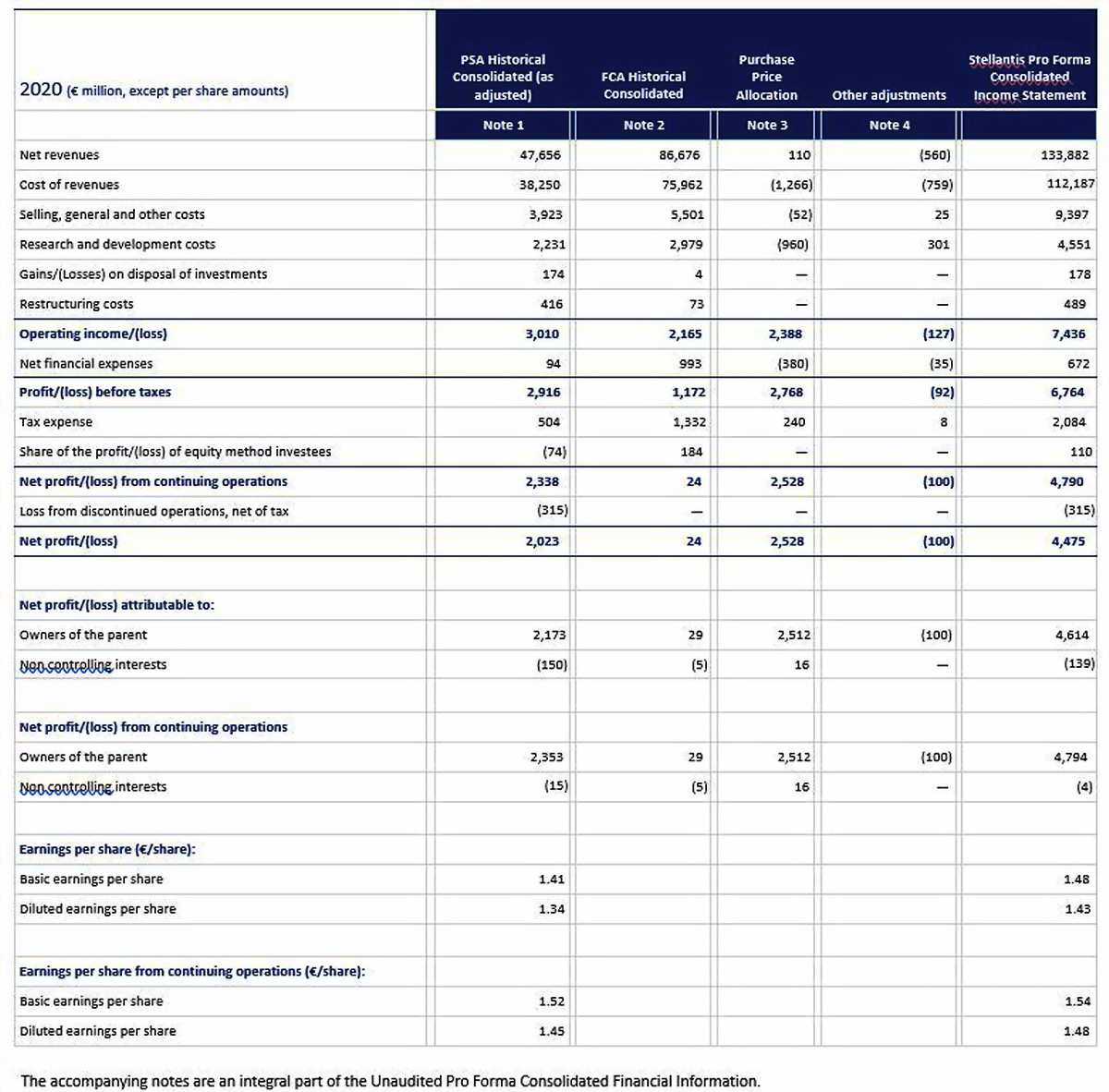

UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL INFORMATION

This Unaudited Pro Forma Consolidated Financial Information has been prepared to give effect to completion of the merger of PSA and FCA to create Stellantis, which was completed on January 17, 2021, as if it had been completed on January 1, 2020. The Unaudited Pro Forma Consolidated Financial Information includes the unaudited pro forma consolidated income statement for years ended December 31, 2021 and 2020 and the related explanatory notes (the “Unaudited Pro Forma Consolidated Financial Information”). The Unaudited Pro Forma Consolidated Financial Information has been prepared for illustrative purposes only with the aim to provide comparative period income statement information, and does not necessarily represent what the actual results of operations would have been had the merger been completed on January 1, 2020. Additionally, the Unaudited Pro Forma Consolidated Financial Information does not attempt to represent, or be an indication of, the future results of operations or cash flows of Stellantis. No pro forma statement of financial position has been presented as the effects of the merger have been reflected in the Consolidated Statement of Financial Position of Stellantis as of December 31, 2021.

The Unaudited Pro Forma Consolidated Financial Information presented herein is derived from (i) the Consolidated Income Statement of Stellantis for the years ended December 31, 2021 and 2020, (ii) FCA’s Consolidated Income Statement for the year ended December 31, 2020, contained in FCA’s Annual Report on Form 20-F filed with the SEC on March 4, 2020, (iii) the consolidated statement of income included in the audited consolidated financial statements of PSA for the year ended December 31, 2020 in the Consolidated Financial Statements and Management’s Discussion and Analysis of Groupe PSA on Form 6-K, furnished to the SEC on March 4, 2021, and (iv) FCA’s accounting records for the period from January 1, 2021 to January 16, 2021. The Unaudited Pro Forma Consolidated Financial Information should be read in conjunction with the historical consolidated financial statements referenced above and the accompanying notes thereto.

The consolidated financial statements of Stellantis, PSA and FCA are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and in accordance with IFRS as adopted by the European Union. There is no effect on the consolidated financial statements resulting from differences between IFRS as issued by the IASB and IFRS as adopted by the European Union. The Unaudited Pro Forma Consolidated Financial Information is prepared on a basis that is consistent with the accounting policies used in the preparation of the Consolidated Financial Statements of Stellantis as of and for year ended December 31, 2021 and 2020.

The historical consolidated financial information has been adjusted in the accompanying Unaudited Pro Forma Consolidated Financial Information to give effect to unaudited pro forma events that are directly attributable to the merger and factually supportable. Specifically, the pro forma adjustments relate to the following:

- The purchase price allocation, primarily to reflect adjustments to depreciation and amortization associated with the acquired property, plant and equipment and intangible assets with a finite useful life, as well as a reduction in the interest expense related to the fair value adjustment to financial liabilities.

- The alignment of accounting policies of FCA to those applied by Stellantis.

- The elimination of intercompany transactions between FCA and PSA.

The pro forma adjustments relate to the two periods from January 1, 2020 to December 31, 2020 and from January 1, 2021 to January 16, 2021.

The Unaudited Pro Forma Consolidated Financial Information does not reflect any anticipated synergies, operating efficiencies or cost savings that may be achieved, or any integration costs that may be incurred, following the completion of the merger.

NOTES TO UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL INFORMATION

Note 1 – Stellantis

This column represents the Consolidated Income Statement of Stellantis for the year ended December 31, 2021 and the PSA Historical Consolidated Income Statement (as adjusted) for the year ended December 31, 2020, which is derived from the historical consolidated statement of income of PSA for the year ended December 31, 2020.

In accordance with IFRS 3, PSA was determined to be the acquirer for accounting purposes, therefore, the year ended December 31, 2020 represents the continuing operations of PSA.

Note 2 – FCA Historical

This column represents FCA’s results for the period from January 1, 2021 to January 16, 2021, as derived from FCA’s accounting records as well as the FCA consolidated income statement included in FCA’s audited consolidated financial statements for the year ended December 31, 2020. In order to conform to the presentation of Stellantis in its Consolidated Income Statement for the years ended December 31, 2021 and 2020, Results from investments related to equity method investments are reclassified to Share of the profit of equity method investees, and Results from Investments other than equity method investments are reclassified to Net financial expenses.

Note 3 – Purchase Price Allocation

As noted in the introduction to this Unaudited Pro Forma Consolidated Financial Information, the merger has been accounted for using the acquisition method of accounting in accordance with IFRS 3, with PSA identified as the accounting acquirer (reverse acquisition accounting). The acquisition method of accounting under IFRS 3 applies the fair value concepts defined in IFRS 13 and requires, among other things, that the assets acquired and the liabilities assumed in a business combination be recognized by the acquirer at their fair values as of the merger date, which for accounting purposes was January 17, 2021. As a result, the acquisition method of accounting has been applied and the assets and liabilities of FCA have been recognized at the merger acquisition date at their respective fair values, with limited exceptions as permitted by IFRS 3. The excess of the consideration transferred over the fair value of FCA’s assets acquired and liabilities assumed has been recorded as goodwill.

The Unaudited Pro Forma Consolidated Financial Information reflects the effects of the purchase accounting adjustments, where applicable, on the unaudited pro forma consolidated income statement for the years ended December 31, 2021 and 2020 as if the merger had occurred on January 1, 2020.

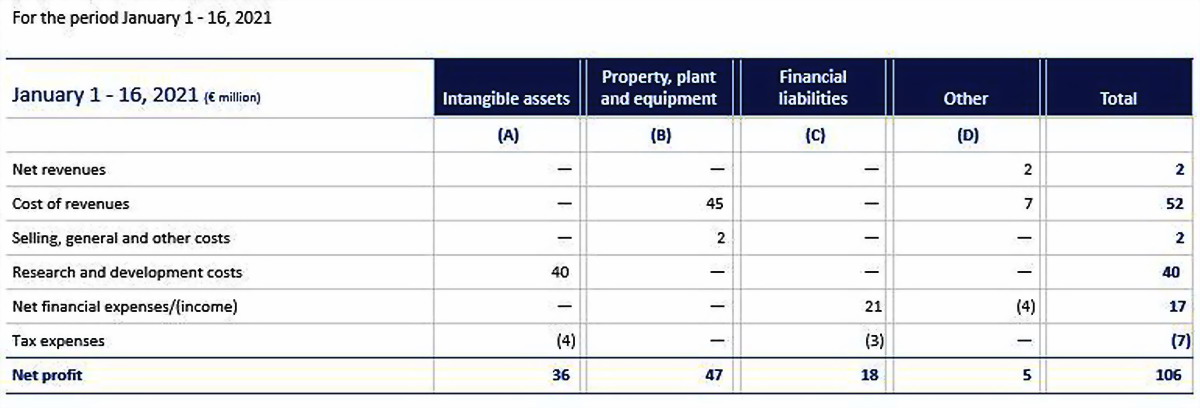

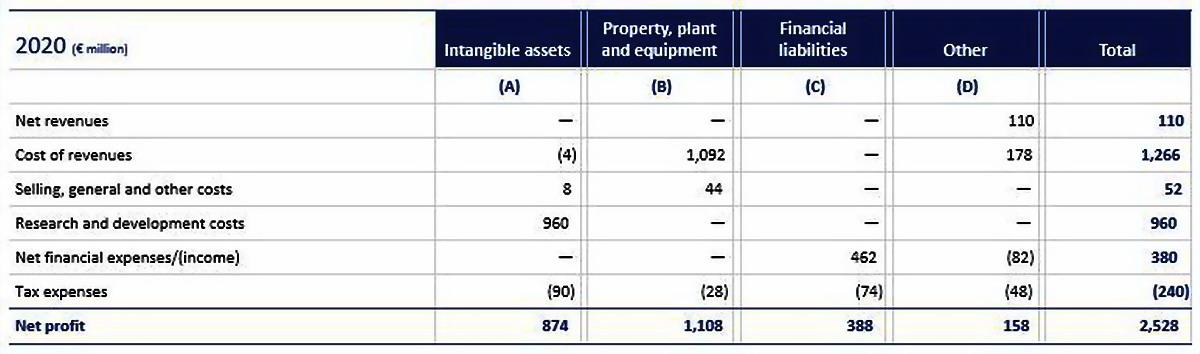

The following tables provide a summary of the pro forma effects of the purchase price allocation adjustments in the unaudited pro forma consolidated income statement for the years ended December 31, 2021 and 2020.

The pro forma adjustments are described in further detail below.

- Intangible assets

The fair value of brands (Jeep, Ram, Dodge, Fiat, Maserati, Alfa Romeo and Mopar) was determined through an income approach based on the relief from royalty method, which requires an estimate of future expected cash flows. The useful life associated with the brands is determined to be indefinite. For capitalized development expenditures, the fair value has been assessed according to a multi-criteria approach based on relief from royalty method and an excess-earning method. The fair value for the Dealer network has been assessed using the replacement cost method. The fair value of reacquired rights has been valued based on the discounted cash flows expected from the related agreement.

Amortization of intangible assets has been calculated on the fair value taking into account the estimated remaining useful life of the acquired assets. The related change in amortization as a result of the fair value adjustment to intangible assets was a net decrease in amortization expense of €40 million and €964 million for the period January 1 to January 16, 2021 and for the year ended December 31, 2020, respectively, of which €40 million and €960 million has been recorded within Research and development costs in relation to capitalized research and development costs and other intangible assets, respectively, and €8 million has been recorded within Selling, general and other costs in relation to the dealer network and (4) million has been recorded within Cost of revenues in relation to reacquired rights for the year ended December 31, 2020.

- Property, plant and equipment

The fair value of property, plant and equipment was determined primarily through the replacement cost method, which requires an estimation of the physical, functional and economic obsolescence of the related assets. A market approach, which requires the comparison of the subject assets to transactions involving comparable assets, was applied to determine the fair value of land. The fair value of certain assets was determined through an income approach.

Depreciation has been calculated on the fair value taking into account the estimated remaining useful life of the acquired assets. The related change in depreciation as a result of the fair value adjustment to property, plant and equipment was a decrease in depreciation expense of €47 million and €1,136 million for the period January 1 to January 16, 2021 and for the year ended December 31, 2020, respectively, of which €45 million and €1,092 million has been recorded within Cost of revenues and €2 million and €44 million has been recorded within Selling, general and other costs in the Unaudited Pro Forma Consolidated Financial Information.

- Financial liabilities

Purchase price adjustments were recognized to step up to fair value the financial liabilities based on quoted market prices for listed debt and based on discounted cash flow models for debt that is not listed. The fair value adjustments to financial liabilities resulted in a decrease in interest expense due to the decrease of the effective interest rate based on current market conditions, of €21 million and €462 million for the period January 1 to January 16, 2021 and for the year ended December 31, 2020, respectively, and has been recorded within Net financial income (expense) in the Unaudited Pro Forma Consolidated Financial Information.

- Other

Primarily reflects:

- the recognition of additional revenue of €2 million and €54 million for the period January 1 to January 16, 2021 and for the year ended December 31, 2020, respectively, as a result of a step up to fair value of deferred revenue relating to extended warranty service contracts, as well as additional finance costs of €4 million and €93 million for the period January 1 to January 16, 2021 and for the year ended December 31, 2020, respectively, due to the recognition of the fair value adjustments of the related liabilities.

- the reversal of the impact on cost of revenues of €7 million and €232 million for the period January 1 to January 16, 2021 and for the year ended December 31, 2020, respectively, of certain prepaid assets that were written off as part of the purchase price allocation.

The step up in the value of inventories has not been recognized as a pro forma adjustment as this impact has been recognized in Stellantis results for the year ended December 31, 2021.

- Tax expense

Represents the tax effects on the pro forma adjustments reflected in the unaudited pro forma consolidated income statement, calculated based on statutory tax rates applicable in the relevant jurisdictions.

Note 4 – Other Adjustments

Other adjustments mainly include the following:

- the elimination of the intercompany transactions with Sevel in the Stellantis Consolidated Income Statement for the year ended December 31, 2020 of €534 million. Sevel is a joint operation that was previously owned 50 percent each by both PSA and FCA. Upon completion of the merger, Stellantis holds 100 percent of Sevel, which is fully consolidated from that date;

- The alignment of FCA’s accounting policies to Stellantis accounting policies resulting in a net decrease in Net profit of €100 million for the year ended December 31, 2020, primarily relating to an increase in Research and development expenditures expensed.

- the alignment of the classification of certain items to align to Stellantis’ income statement presentation.

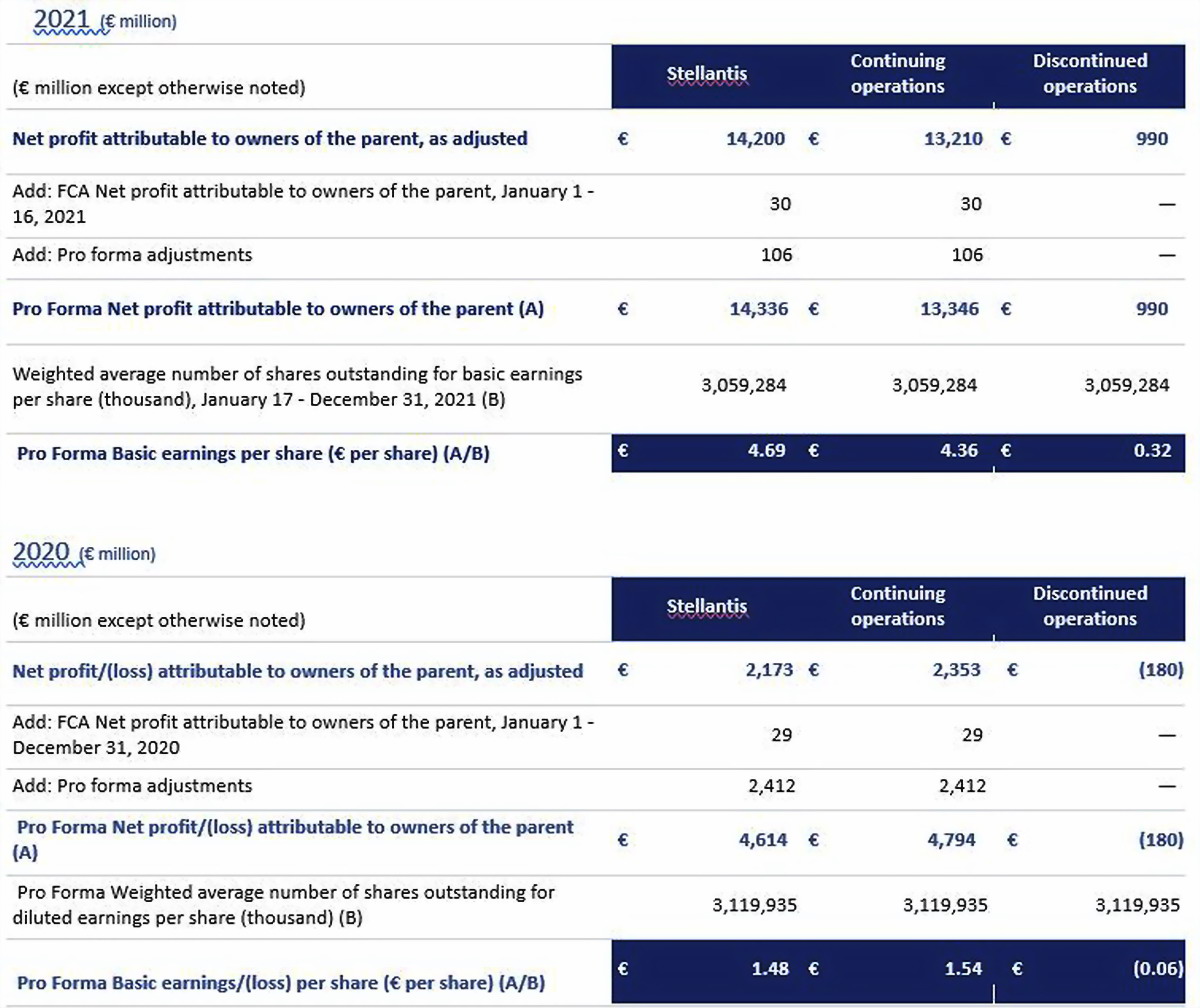

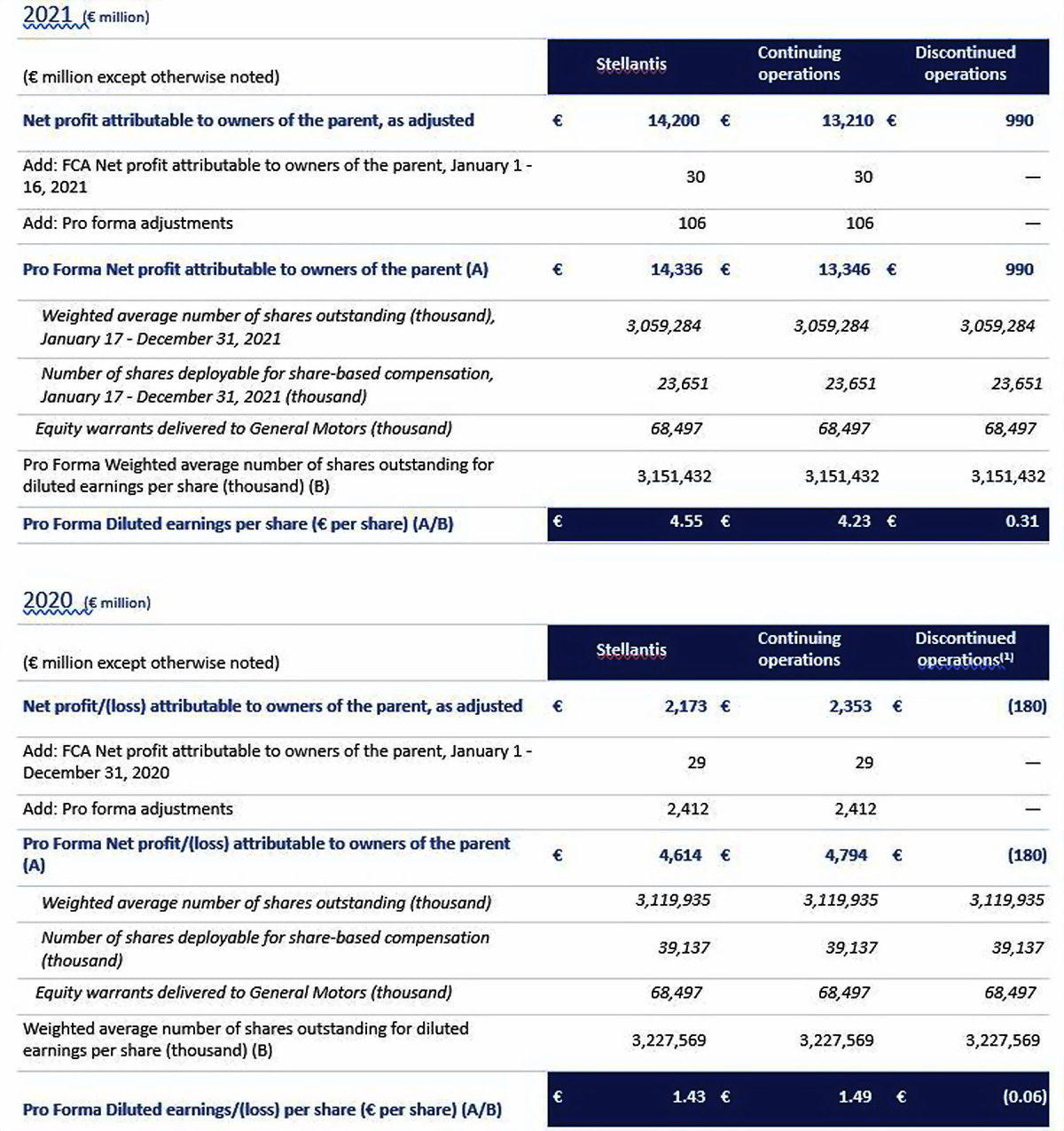

Note 5 – Pro Forma Earnings per Share

Pro Forma basic earnings per share is calculated by dividing the Pro Forma Net profit from continuing operations attributable to the owners of the parent by the Pro Forma weighted average number of shares outstanding, as adjusted for the merger.

Pro Forma diluted earnings per share is calculated by adjusting the historical diluted weighted average number of shares outstanding with the Pro Forma weighted average number of dilutive shares outstanding, as adjusted for the merger.

Regarding the Pro Forma basic and diluted earnings per share from continuing operations for the year ended December 31, 2020:

(i) Pro forma weighted average number of outstanding Stellantis common shares for the year ended December 31, 2020 includes PSA weighted average number of outstanding common shares for the year ended December 31, 2020 converted with the merger exchange ratio of 1.742 and Stellantis common shares issued at the merger date;

(ii) The number of the equity warrants on PSA ordinary shares delivered to General Motors, amounting to 39,727,324, have been included in the diluted number of shares and converted with the merger exchange ratio of 1.742;

(iii) Pro forma weighted average number of outstanding Stellantis common shares resulting from dilutive equity instruments performance share plans issued by PSA and converted with the merger exchange ratio of 1.742; and

(iv) Pro forma weighted average number of outstanding Stellantis common shares resulting from the equity instruments issued under FCA’s equity incentive plan.

Pro Forma Basic earnings per share

Pro Forma Diluted earnings per share

(1) Number of shares deployable for share-based compensation and equity warrants delivered to General Motors have not been taken into consideration in the calculation of diluted loss per share for the year ended December 31, 2020 as this would have had an anti-dilutive effect

SAFE HARBOR STATEMENT

This document, in particular references to “2022 Guidance”, contains forward looking statements. In particular, statements regarding future financial performance and the Company’s expectations as to the achievement of certain targeted metrics, including revenues, industrial free cash flows, vehicle shipments, capital investments, research and development costs and other expenses at any future date or for any future period are forward-looking statements. These statements may include terms such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “remain”, “on track”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “outlook”, “prospects”, “plan”, or similar terms. Forward-looking statements are not guarantees of future performance. Rather, they are based on the Company’s current state of knowledge, future expectations and projections about future events and are by their nature, subject to inherent risks and uncertainties. They relate to events and depend on circumstances that may or may not occur or exist in the future and, as such, undue reliance should not be placed on them.

Actual results may differ materially from those expressed in forward-looking statements as a result of a variety of factors, including: the continued impact of unfilled semiconductor orders; the Company’s ability to realize the anticipated benefits of the merger, the continued impact of the COVID-19 pandemic; the Company’s ability to launch new products successfully and to maintain vehicle shipment volumes; the Company’s ability to successfully manage the industry-wide transition from internal combustion engines to full electrification; changes in the global financial markets, general economic environment and changes in demand for automotive products, which is subject to cyclicality; changes in local economic and political conditions; changes in trade policy, the imposition of global and regional tariffs or tariffs targeted to the automotive industry, the enactment of tax reforms or other changes in tax laws and regulations; the Company’s ability to produce or procure electric batteries with competitive performance, cost and at required volumes; the Company’s ability to offer innovative, attractive products and to develop, manufacture and sell vehicles with advanced features including enhanced electrification, connectivity and autonomous driving characteristics; various types of claims, lawsuits, governmental investigations and other contingencies, including product liability and warranty claims and environmental claims, investigations and lawsuits; material operating expenditures in relation to compliance with environmental, health and safety regulations; the level of competition in the automotive industry, which may increase due to consolidation; exposure to shortfalls in the funding of the Company’s defined benefit pension plans; the Company’s ability to provide or arrange for access to adequate financing for dealers and retail customers and associated risks related to the establishment and operations of financial services companies; the Company’s ability to access funding to execute its business plans; a significant malfunction, disruption or security breach compromising information technology systems or the electronic control systems contained in the Company’s vehicles; the Company’s ability to realize anticipated benefits from joint venture arrangements; disruptions arising from political, social and economic instability; risks associated with the Company’s relationships with employees, dealers and suppliers; increases in costs, disruptions of supply or shortages of raw materials, parts, components and systems used in the Company’s vehicles; developments in labor and industrial relations and developments in applicable labor laws; exchange rate fluctuations, interest rate changes, credit risk and other market risks; political and civil unrest; earthquakes or other disasters; and other risks and uncertainties.

Any forward-looking statements contained in this document speak only as of the date of this document and the Company disclaims any obligation to update or revise publicly forward-looking statements. Further information concerning the Company and its businesses, including factors that could materially affect the Company’s financial results, is included in the Company’s reports and filings with the U.S. Securities and Exchange Commission and AFM.

Motori360.it Portale motoristico a 360 gradi: auto e moto (test su strada su testmotori360.it), anticipazioni, retrospettive, ecc. – aeronautica – nautica – trasporti – viaggi – tecnologie – sport – abbigliamento – inchieste – consigli

Motori360.it Portale motoristico a 360 gradi: auto e moto (test su strada su testmotori360.it), anticipazioni, retrospettive, ecc. – aeronautica – nautica – trasporti – viaggi – tecnologie – sport – abbigliamento – inchieste – consigli

Testata giornalistica registrata presso il Tribunale di Roma con il n. 147/2012

Testata giornalistica registrata presso il Tribunale di Roma con il n. 147/2012